- Insights & Updates

Latest News

By Chief Analyst

September 13, 2025Why Are Million Dollar HDBs Making Headlines in Singapore?

The term “million-dollar HDB” once sounded sensational, almost contradictory to the Housing and Development Board’s (HDB) original vision of affordable housing for Singaporeans. Yet in recent years, resale flats breaching the million-dollar mark have become increasingly common, particularly in mature estates and unique property types.

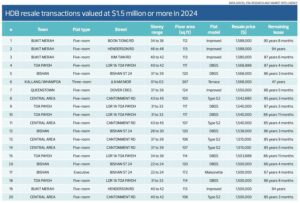

In 2024 alone, over 400 flats crossed the $1 million threshold, with transactions recorded in Bishan, Toa Payoh, Tiong Bahru, Queenstown, and even newer areas near integrated transport hubs. The highest transaction was recorded at $1.588 million in Boon Tiong Road. These figures highlight how public housing, while meant to be accessible, is increasingly functioning as both a home and a wealth-building asset.

The rise of million-dollar HDBs captures headlines not only because of their eye-popping price tags but also because of the broader implications: affordability concerns for younger buyers, shifts in housing demand, and the growing interplay between public housing and Singapore’s property market. To understand why some flats command such premiums, we must examine the factors that drive their prices upward.

Prime Locations

Location has always been the most powerful driver of property values, and HDB flats are no exception. Million-dollar transactions are concentrated in estates such as Bishan, Queenstown, and Tiong Bahru, where proximity to the Central Business District (CBD) makes daily commuting easier.

City fringe living also comes with lifestyle advantages. Residents enjoy shorter travel times, abundant amenities, and access to prestigious schools. For example, a Bishan flat near Catholic High or Raffles Institution appeals strongly to family buyers seeking both convenience and educational prestige.

The scarcity of land in these areas further amplifies demand. Unlike emerging towns such as Tengah or Punggol, mature estates have limited room for new developments. With fewer options available, buyers with stronger financial capacity compete fiercely for existing units, pushing resale prices into seven-figure territory.

Accessibility and Lifestyle Factors

Beyond location, accessibility to transportation networks and lifestyle amenities plays a critical role in driving prices. Many million-dollar flats sit within walking distance of MRT stations, shopping malls, hawker centres, and healthcare facilities.

Consider Queenstown: with its central location, multiple MRT lines, and rapid access to Orchard Road or Raffles Place, it offers both convenience and lifestyle appeal. Similarly, Tiong Bahru combines heritage charm with trendy cafés and boutiques, creating a unique neighbourhood identity that appeals to younger, affluent buyers.

Lifestyle amenities amplify perceived value. Buyers are not just purchasing a flat, they are buying into a neighbourhood ecosystem that supports convenience, culture, and comfort. This intangible factor often justifies the premium attached to million-dollar HDBs.

Bigger Layouts and Rare Units

Another driver of soaring prices is flat size and rarity. Million-dollar HDBs are often executive maisonettes, jumbo flats, or Design, Build and Sell Scheme (DBSS) units. These properties are no longer in production, making them rare gems in the HDB market.

For instance, jumbo flats, created by merging two adjacent units, offer living spaces of 150–180 sqm, comparable to private condominiums but at a lower price point. Executive maisonettes, with their two-storey layouts, provide a sense of landed living within public housing. DBSS units, built by private developers, also stand out for their premium finishes and layouts.

The scarcity of these unit types means that once they enter the resale market, demand outstrips supply. Buyers who value space for multi-generational living or lifestyle upgrades are willing to pay the million-dollar price tag.

Impact on Financing a Million-Dollar HDB

While the lifestyle appeal of million-dollar flats is undeniable, financing such purchases is a serious consideration. Unlike private properties, HDBs come with Mortgage Servicing Ratio (MSR) and Loan-to-Value (LTV) rules that limit how much buyers can borrow. Check out this article on how much you much you need to purchase a HDB in Singapore

MSR and LTV

The Mortgage Servicing Ratio (MSR) limits the portion of a borrower’s monthly income that can be allocated toward mortgage repayments for HDB flats. The cap is set at 30% of gross monthly income, which directly reduces the maximum loan quantum. For a $1 million HDB flat, this means buyers must demonstrate significant earning capacity or provide a substantial cash/CPF down payment.

The Loan-to-Value (LTV) limit further shapes affordability.

- For HDB concessionary loans, buyers can borrow up to 75% of the flat price, and the remaining down payment of 25% can be paid through cash or CPF savings.

- For bank loans, the LTV is also capped at 75%, but with a minimum of 5% of the purchase price payable in cash.

Applying these rules to a $1 million purchase:

- With an HDB loan, buyers need a $250,000 down payment (CASH/CPF).

- With a bank loan, they require $250,000 upfront, including $50,000 in cash.

For young families, such sums may feel daunting, especially when combined with other costs, such as stamp duties, renovations, and furniture.

This is where mortgage planning becomes critical. Comparing loan packages, understanding interest rate trends, and planning cash flow are essential for avoiding financial strain. As Singapore’s largest independent mortgage broker, Fairloan Mortgage Advisory guides buyers through this complexity, ensuring they secure the best possible deal.

Do Million Dollar HDBs Signal a Bubble or a New Normal?

Why These Transactions Matter

Million-dollar HDBs are more than just expensive homes, they are indicators of how Singapore’s property market is evolving. Each record-breaking sale reflects changing buyer expectations, rising household incomes, and a willingness to pay a premium for lifestyle convenience.

At the same time, these transactions highlight the tension between HDB’s role as an affordable housing provider and its function as a financial asset. For policymakers, this raises important questions: how to preserve affordability for first-time buyers while respecting market forces that naturally drive prices upward.

Impact on Affordability and Younger Buyers

For younger Singaporeans, the rise of million-dollar flats can feel discouraging. Many aspire to live in central estates but find themselves priced out due to the high entry costs. As a result, more young couples turn to Build-to-Order (BTO) projects in non-mature estates, where prices remain within reach but come with longer waiting times.

This shift widens the socio-economic divide between households that can afford central resale flats and those who cannot. It also intensifies competition for BTO launches, especially in mature estates where quota restrictions apply.

In the long run, affordability concerns may affect fertility trends, household formation, and even perceptions of social equity, issues that go far beyond housing itself.

How It Shapes Long-Term Housing Trends

The growing prevalence of million-dollar HDBs signals several long-term trends:

- Public Housing as Asset Class: HDBs, once seen purely as affordable housing, are increasingly treated as wealth-building instruments.

- Greater Demand for Space: As families prioritise larger homes, demand for jumbo flats, maisonettes, and spacious resale units will remain strong.

- Continued Policy Intervention: To balance affordability and asset appreciation, the government may introduce further measures, such as lease decay adjustments, additional subsidies, or tighter eligibility rules.

- Shift to New Towns: Younger buyers unable to afford mature estates will accelerate demand in newer estates such as Tengah, Punggol, and Jurong Lake District, reshaping Singapore’s housing map over the next decade.

These shifts suggest that million-dollar HDBs are not a short-lived bubble but rather part of a new normal in which premium public housing coexists with ongoing affordability challenges.

Million Dollar HDB: Dream Home or Financial Burden?

Million-dollar HDB reflect both the aspirations and anxieties of Singapore’s property landscape. On one hand, they demonstrate the enduring appeal of central locations, spacious layouts, and well-connected neighbourhoods. On the other hand, they underscore the growing financial pressures faced by younger buyers navigating strict MSR and LTV rules.

Ultimately, whether a million-dollar HDB is worth it depends on individual priorities. For families seeking space and convenience, it may be a worthwhile investment. For others, the financial strain may outweigh the benefits.

What is clear is that buying such a property demands careful mortgage planning. With proper guidance, buyers can make confident and informed decisions. At Fairloan Mortgage Advisory, we help clients compare rates across all major banks, optimise their loan strategies, and secure the best possible financing for their dream home.

PS: Million-dollar HDBs may grab headlines, but your mortgage should never be left to chance. Reach out today to plan your path with confidence.

FAQS

- Why are HDB flats selling for over $1 million?

Million-dollar HDBs are driven by a mix of prime locations, rare layouts (jumbo, maisonette, DBSS), strong accessibility, and remaining lease value. Buyers are willing to pay a premium for convenience, space, and lifestyle advantages that are hard to replicate in newer estates. - Are million-dollar HDBs worth buying?

It depends on your goals. For families, they can still be cheaper than private condos in the same area. For investors, restrictions like MSR and rental rules make capital appreciation slower. Ultimately, the decision comes down to financial sustainability and lifestyle needs. - How much down payment do I need for a $1 million HDB?

- With an HDB loan: minimum $250,000 down payment (can be CPF + cash).

- With a bank loan: minimum $250,000, of which at least $50,000 must be in cash.

- Will million-dollar HDBs affect housing affordability in Singapore?

Yes, these record transactions highlight rising costs in mature estates, making it harder for younger buyers to enter the resale market. This drives more demand toward BTO launches in non-mature towns, while the government continues to strike a balance between affordability and asset growth.

Explore related content by topic

SORA vs Fixed Rate Home Loans in Singapore (Sept 2025): Which is Better?

With Daily SORA dipping below 1% in Sept 2025, Singapore homebuyers face a key choice: lock in historic low fixed rates from 1.65%–1.75%, or ride SORA packages where they can enjoy at 1.3%–1.5% potentially. Beyond rates, features like penalty waivers, partial prepayments, and free conversions after one year make the right mortgage strategy more important than ever.

With growth in Singapore slowing and inflation moderating, the key question now becomes: Should homeowners opt for Fixed‑rate stability or Floating‑rate flexibility?