- Insights & Updates

Latest News

By Chief Analyst

August 18, 2025In 2025, the question uppermost in the minds of aspiring homeowners in Singapore is simple yet daunting: “How much do I need to buy a HDB flat?”

Although public housing remains emblematic of Singapore’s success in affordable homeownership, escalating resale prices and regulatory shifts have tightened the path.

Yet, beneath this complexity lie precise calculations, realistic grant structures, and viable strategies for those who plan carefully.

Current HDB Price Levels

A foundational step in understanding affordability is anchoring expectations to real numbers. In June 2025, the average resale HDB flat price hovered around S$652,700, marking a slight dip from S$657,400 a month prior.

Among 4-room flats, the previous quarter’s average was approximately S$674,470, reflecting a modest 1.4% quarter-on-quarter increase. Yet, even as many flats fall under S$650,000, 63% of 4-room transactions in 1H 2025, the continual rise of million-dollar flats, making up 4.3% of sales, signals mounting pressure on affordability.

In central areas, the median resale price for 4-room flats soared to S$1.2 million in Q2 2025.

Breakdown of Costs You Must Know

Downpayment and Loan Constraints

In 2025, the maximum loan-to-value (LTV) ratio for both HDB and bank loans is capped at 75%, meaning buyers must cover at least 25% of the flat price from CPF or cash.

- For an HDB loan, that means a 25% down payment, fully payable via CPF-OA or cash.

- For a bank loan, the downpayment requirement is also 25%; but, at least 5% must be cash, while the remaining 20% can be paid via CPF-OA.

Other Fees(Misc Fees)

Beyond the down payment, buyers must factor in stamp duties, legal fees, valuation fees, and agent fees too. Commonly ranging from S$15,000 to S$30,000, depending on the purchase price.

Example: HDB Purchase price: $650,000

i) Downpayment 25% = $162,500 (CPF-OA/Cash; for bank loan, min 5% Cash)

ii) Legal Fee: est $1000-1500 (CPF-OA/Cash)

iii) Valuation fee: $120 (Cash)

iv) Buyer Stamp Duty: $14,100 (CPF-OA/Cash)

v) Property Agent Fee 1% = $6,500 (Cash)

*Assuming no Cash Over Valuation (COV)

Government Grants That Make a Difference

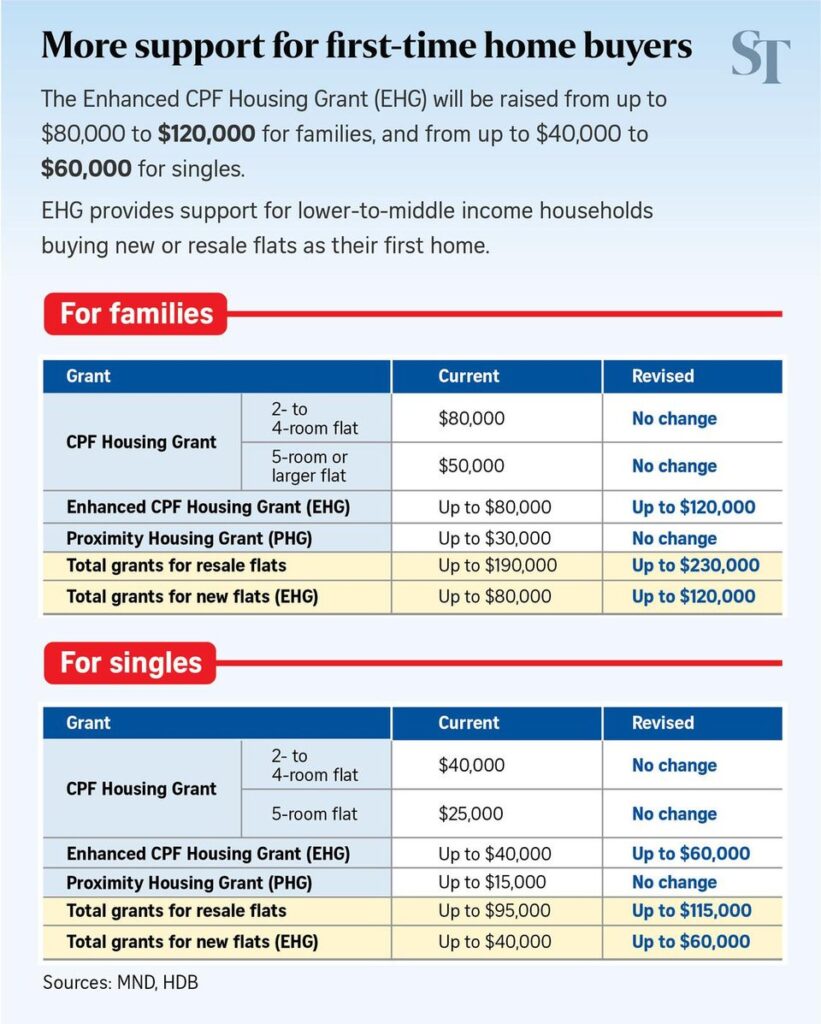

Credit: The Straits Times

Singapore provides generous grants that can soften what seems like steep costs:

Enhanced CPF Housing Grant (EHG)

- Families (two first-timer applicants): up to S$120,000, income ceiling of S$9,000/month

- Singles: eligible for up to S$60,000 (or S$120,000 if applying with other singles), with income ceiling rules adjusted accordingly.

Resale Flat Specific Grants

- On top of EHG, CPF Housing Grant of up to S$80,000, and Proximity Housing Grant (PHG) up to S$30,000, are also available.

- Combined, a first-timer family buying resale may access up to S$230,000 in grants

Implication: Grants can reduce the effective purchase price significantly—making a S$700,000 flat feel far more attainable.

Financing Options: HDB Loan vs Bank Loan

Navigating your mortgage choice hinges on more than interest rates:

HDB Loan

- Fixed interest at 2.6% p.a. (0.1% above CPF OA)

- Predictable and stable, easing budgeting for long-term households

- Requires CPF OA usage and has certain eligibility caps.

However, not everyone is eligible. The following groups are not allowed to take an HDB loan:

- PR–PR Households: If both buyers are Singapore Permanent Residents (SPRs), they are ineligible for an HDB loan and must take a bank loan instead.

- Multiple Loan History: Buyers who have already taken two HDB concessionary loans are no longer eligible for a third one.

- Private Property Owners: Buyers who currently own (or have disposed of) private property within the last 30 months cannot use an HDB loan.

- Income Ceilings: For certain flat types, exceeding HDB’s prescribed monthly household income ceiling (currently S$14,000 for families and S$7,000 for singles) may disqualify buyers from using an HDB loan.

- Serious Mortgage Arrears: Buyers with a record of mortgage arrears or who did not keep up with earlier HDB obligations may be disqualified.

In such cases, the only financing path available is through bank loans.

Bank Loan

- Different interest rate packages are available, currently ranging around 1.8% to 2.5%, slightly lower than the HDB concessionary rate.

- Offers flexibility in CPF usage and repayment terms

- Able to use Show Fund or Pledge Funds to increase the loan amount, capped at 75% LTV.

Government Measures and Future Supply

HDB continues addressing demand via supply:

- In 1H 2025, over 5,000 BTO flats and 5,590 Sale-of-Balance Flats (SBF) were launched. A further 19,600 units are expected in the remaining year.

- These supply injections may generate downward pressure on resale prices and provide more affordable alternatives.

Simultaneously, the LTV tightening functions as a cooling measure to temper speculative or unaffordable buying.

Case Studies: Actual Cost Scenarios

Young Couple Buying a 4-Room Resale (Non-Mature Town)

Purchase price: S$650,000

Downpayment (25%): S$162,500 (CPF/HDB loan)

Grants (EHG, Housing, PHG): up to S$230,000

Effective cost: down to ~S$257,500

Monthly mortgage (assuming 25-year HDB loan at 2.6%): ~S$1,170/month

Single Buyer Buying a BTO Flat (~3-room)

Price after subsidies: S$300,000

Downpayment: S$60,000

Grants (EHG singles): up to S$60,000

Loan covers the remaining S$180,000

The interplay of price, grants, and loans reshapes affordability.

Strategic Pathways to Affordability

- Apply for BTO if you can wait; grants and lower prices remain most generous here.

- Target non-mature towns for resale flats, affordable inventory remains available, often under S$650,000

- Optimise grant usage, ensure you qualify and apply early for EHG, Housing Grant, and PHG. Apply for HFE to find out your grant(s) applicable

- Choose HDB loan if you are risk-averse, or bank loan if interest rates favour you.

- Budget conservatively, include renovation, legal fees, monthly CPF commitments, and leave a buffer up to 24months of repayment.

Conclusion: Affordability Is Challenging But Feasible

While the Singapore HDB resale market in 2025 reflects record highs and regulatory busywork, a clear-eyed, grant-savvy, and strategically financed approach makes ownership achievable.

Whether opting for a BTO in a satellite town or a modest resale flat, understanding price levels, downpayment structure, financing modes, and grant entitlements equips you to answer the crucial question:

“How much do I need?” and

“When can I make it happen?”

FAQs

1. How much cash do I need upfront to buy an HDB flat in 2025?

If you take an HDB loan, no minimum cash component is required. The 25% down payment can be fully paid using CPF Ordinary Account (OA) savings.

For a bank loan, at least 5% of the flat price must be paid in cash, with another 20% payable by CPF OA or cash. Buyers also need to prepare cash for legal fees, valuation fees, and misc fees.

2. Can Permanent Residents (PRs) take an HDB loan in 2025?

No. If both buyers are PRs (a PR-PR household), you are not eligible for an HDB loan and must finance the purchase through a bank loan. PRs are also not eligible for most housing grants until at least one applicant becomes a Singapore Citizen.

3. Will I need to return the housing grants if I sell my flat later?

Yes. Upon resale, the grants used, along with accrued interest, must be refunded into your CPF account. Any surplus over S$30,000 will be distributed across your CPF accounts per prevailing rules.

4. Can CPF Housing Grants be used to pay the down payment for HDB flat?

Yes, grants can be used for the downpayment, but only via your CPF OA.

For HDB loans, they can cover the full 25% downpayment. (But do note that the grants comes in slightly before completion date, hence the initial 5-10% downpayment may still be required.

For bank loans, they can only cover the CPF portion (20%), but not the 5% cash requirement.

Explore related content by topic

Why Are Condos So Expensive Now? Singapore 2025 Guide (CCR vs RCR vs OCR)

Condo prices in Singapore remain high in 2025, with URA data showing steady gains across CCR, RCR, and OCR since 2000. Rising land costs, resilient demand, and rental strength underpin values. While yields average 2–4%, condos remain attractive for wealth preservation. Buyers must weigh 99-year vs freehold, and new launch vs resale opportunities carefully.

Why Is My IPA So Low? The Real Reasons Your Home Loan Approval Is Smaller Than Expected

Wondering why your IPA (In-Principle Approval) is so low? This 2025 expert guide explains hidden reasons your home loan approval is smaller than expected, including credit bureau timing, bank policies, stress-test interest rates, variable income haircuts, TDSR issues, and how to increase your loan eligibility legally